|

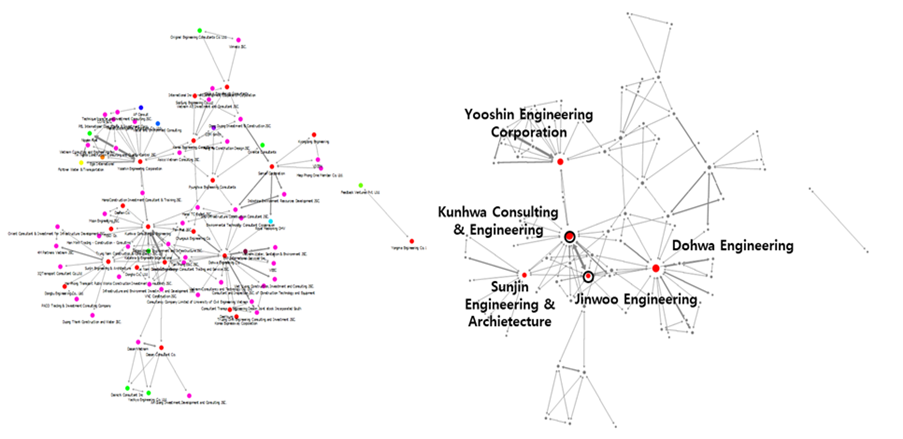

Due to the growth of the domestic construction market, the major domestic engineering and construction companies intend to go in to the

overseas market. However, overseas markets are often exclusively owned by a few major companies. It is also high entry barriers for mid-sized and minor companies, high risks resulting in poor profitability. In order to success in

overseas markets, it is necessary to break away from business management focused on domestic-oriented and deep understanding of individual markets must be preempted. In particular, it is important to make systematic decisions based on

data, away from the experience-oriented business selection and late risk response.

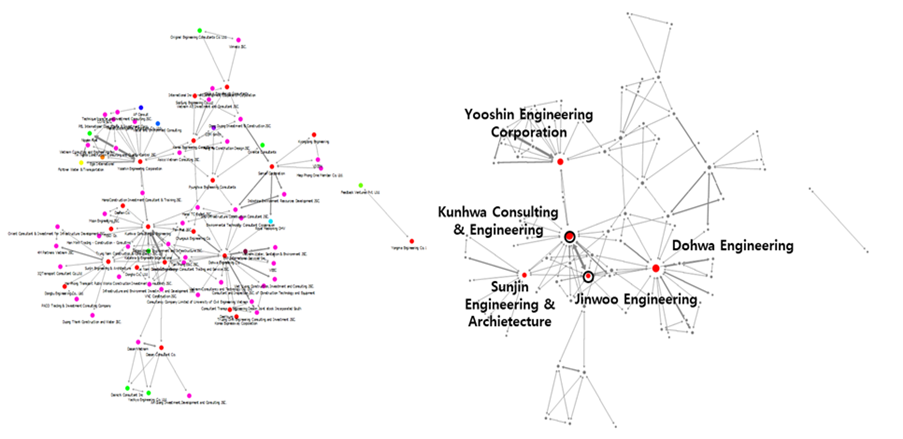

In our lab, we apply Big-Data and Artificial Intelligence (AI) techniques to overseas construction and provide insights on market

analysis, entry strategies, and collaboration methods based on reliable data provided by international organizations such as World Bank, ADB, and UNFCCC.

|

|

|

|

Representative studies conducted on International Construction in i3 lab are as follows.

|

|

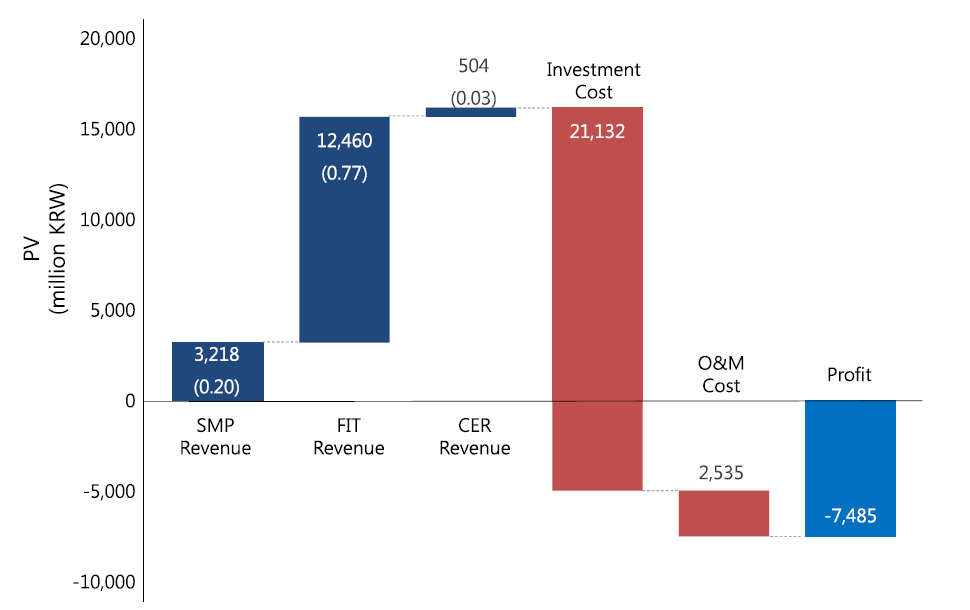

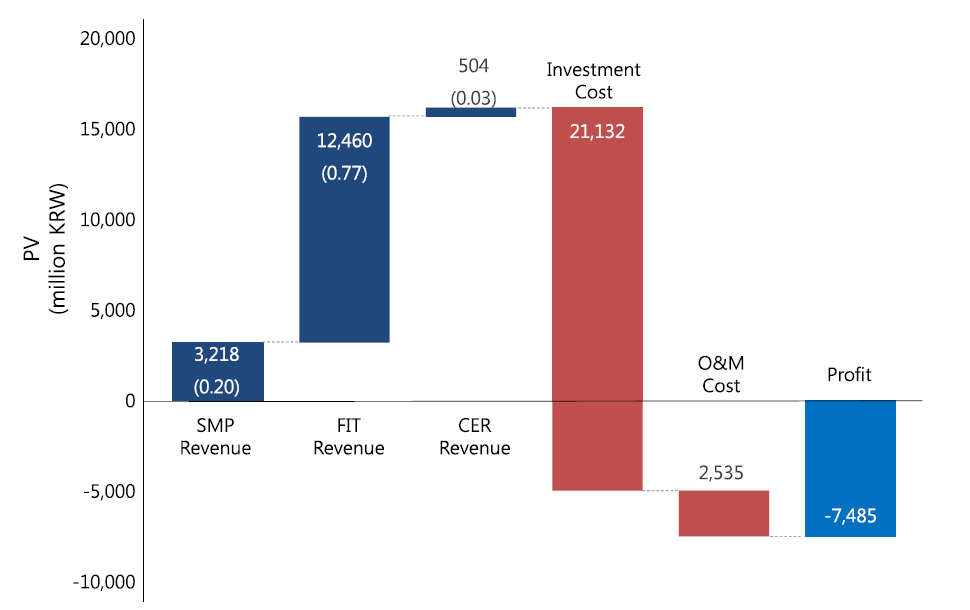

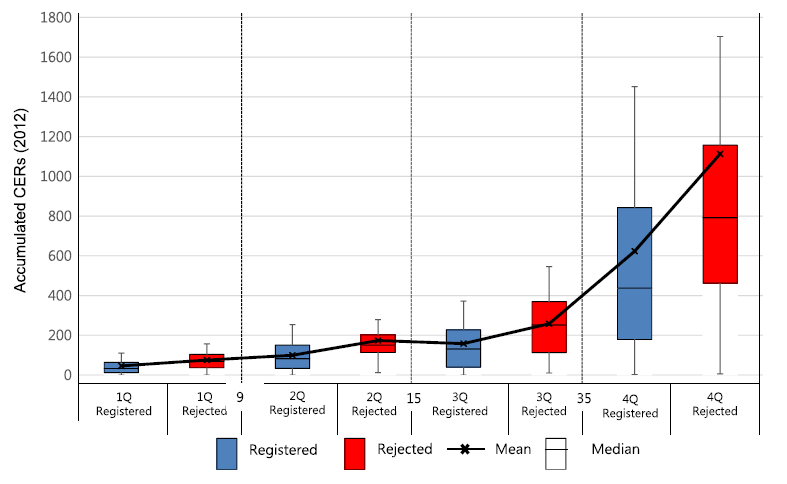

Examining the impacts of Feed-in-Tariff and the Clean Development Mechanism on Korea's renewable energy projects through comparative investment analysis

Examining the impacts of Feed-in-Tariff and the Clean Development Mechanism on Korea's renewable energy projects through comparative investment analysis

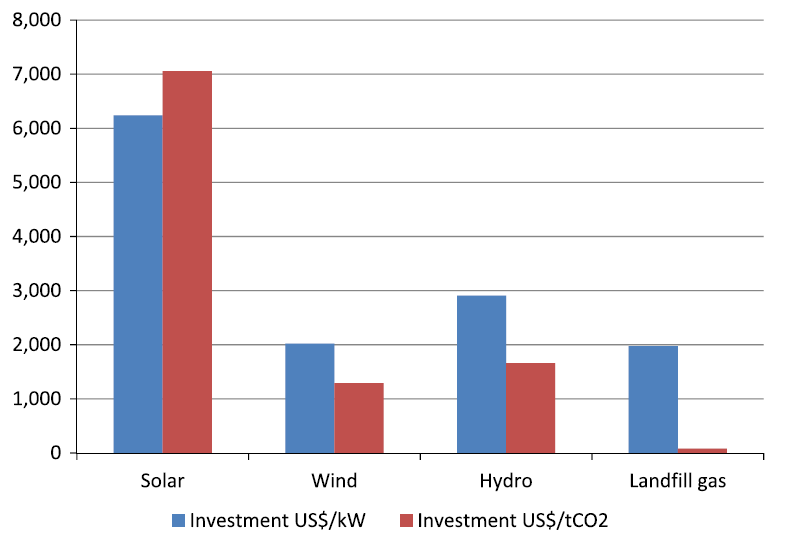

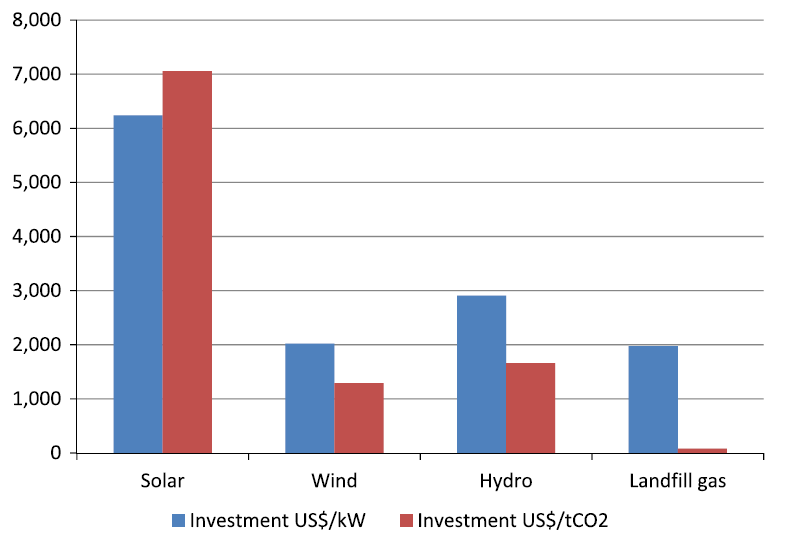

Renewable energy projects in Korea have two avenues that provide

subsidies to increase theirfinancial viability.Feed-in-Tariffs (FITs) offer cost based prices for renewable electricity to compete with conventional energyproducers. The Clean Development Mechanism (CDM) issues certified emission

reduction (CER) credits thatgenerate additional revenues, enhancing renewable projects’return on investment. This study investigated howthese subsidies impact thefinancial returns on Korea's CDM projects. An investment analysis was

performed onfour cases including solar, hydropower, wind and landfill gas projects. Revenues from electricity sales, FITs andCERs were compared usingfinancial indicators to measure their relative contributions on profitability.

Resultsindicate that CDM is partial towards large scale projects with high emission reductions. Moreover, conflicts withFIT schemes can deter small scale, capital intensive projects from pursuing registration. The analysis

highlightsCDM's bias for particular project types, which is in part due to its impartiality towards carbon credit prices. Italso reveals that Korea, a key benefactor of CDM, is susceptible to such biases, as demonstrated by

thedisproportionate distribution of issued CERs. Improving incentives for bundled, small scale projects, CER pricedifferentiation, and excluding domestic subsidies during additionality testing are proposed as possible reforms.

|

|

|

|

|

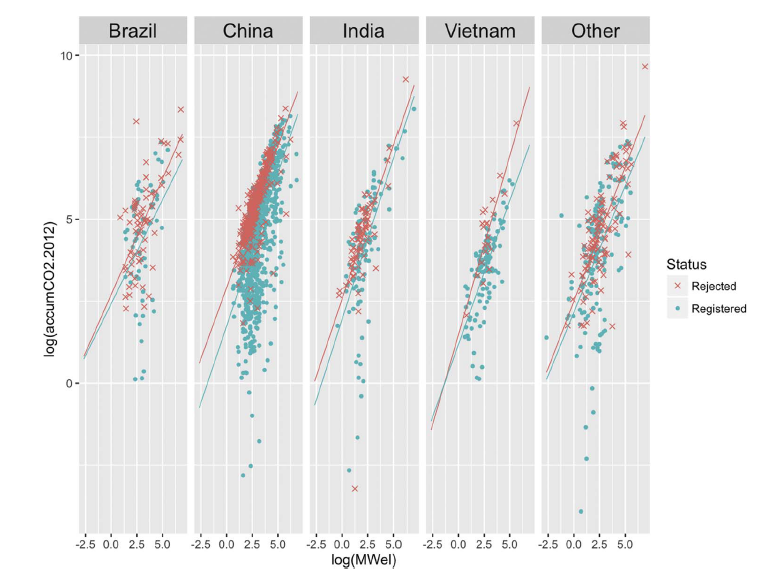

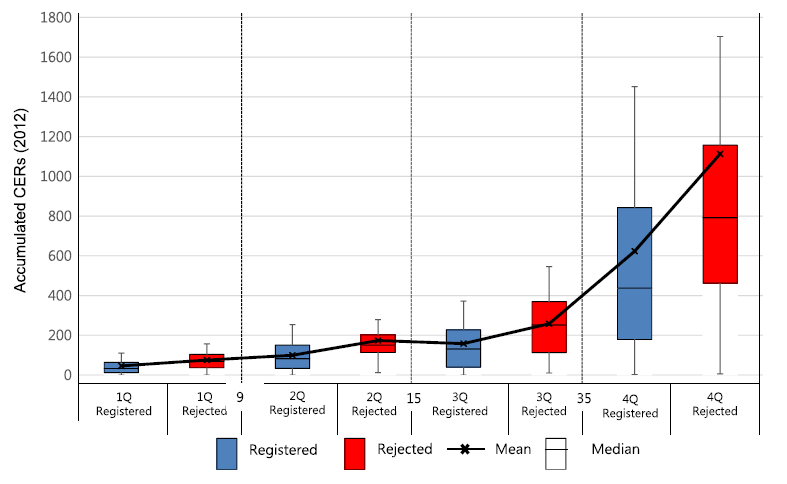

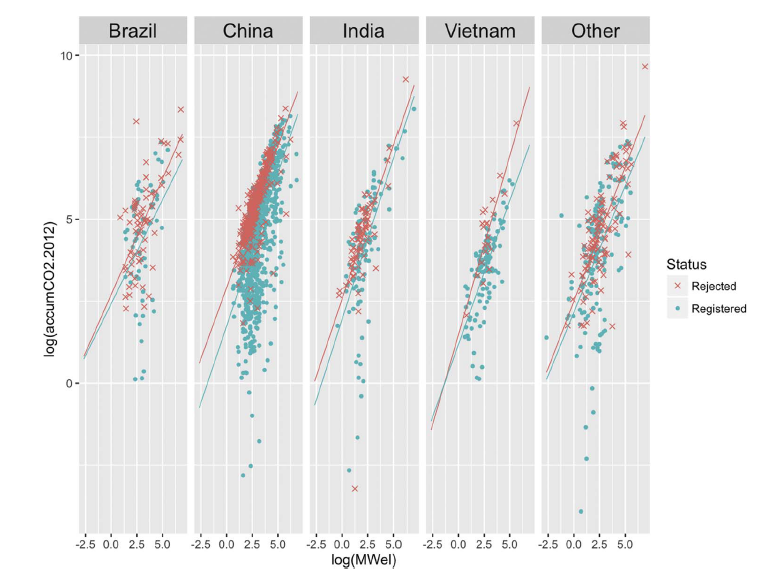

Preparing hydropower projects for the post-Paris regime: An econometricanalysis of the main drivers for registration in the Clean DevelopmentMechanism

Preparing hydropower projects for the post-Paris regime: An econometricanalysis of the main drivers for registration in the Clean DevelopmentMechanism

The 2015

Paris Climate Accords promises to reign in a new era in thefight against global climate change. TheAgreement supports the establishment of new cooperative approaches including internationally transferredmitigation outcomes, through

which individual countries can meet their nationally determined contributions.Hydropower projects, however, are in danger of being left out in the new regime mainly due to its dubiousposition as a renewable energy source. Hydropower

in the Clean Development Mechanism (CDM) has beencriticized for non-conformance to additionality and sustainability objectives originally set out in the KyotoProtocol. To confirm such issues, and to provide recommendations that may

mitigate them, this studyconducted an econometric analysis of 2717 hydropower projects in the CDM pipeline leading up to 2016.Specifically, a logit model was constructed to identify the main drivers for registration success. Results

of theanalysis showed the capacity and expected carbon credits of hydropower projects to be the dominant factors forregistration, rather than theirfinancial requirements or technological barriers. Most problematically, large

scaleprojects not requiring carbon credits were registered, while their social and environmental impacts have notbeen extensively scrutinized. Policy recommendations to rectify the verification process are proposed, so thatwhen

implemented, the right hydropower projects may be included in the new market mechanisms of the post-2020 regime.

|

|

|

|

|

Which strategies are more effective for international contractors during boom and recession periods?

Which strategies are more effective for international contractors during boom and recession periods?

A Multi-objective Linear Programming Framework for Evaluating the Financial Viability of Supplementary Facilities in Build-Transfer-Lease Projects in Korea

A Multi-objective Linear Programming Framework for Evaluating the Financial Viability of Supplementary Facilities in Build-Transfer-Lease Projects in Korea

Formulation of a pull production system for optimal inventory control of temporary rebar assembly plants

Formulation of a pull production system for optimal inventory control of temporary rebar assembly plants

Evaluating the Economic Feasibility of Green Construction Projects using FiT and CDM Support Mechanisms

Evaluating the Economic Feasibility of Green Construction Projects using FiT and CDM Support Mechanisms

|